Essential Compliances

When it comes to compliances, we can help you with a specific task or simply leave everything to us

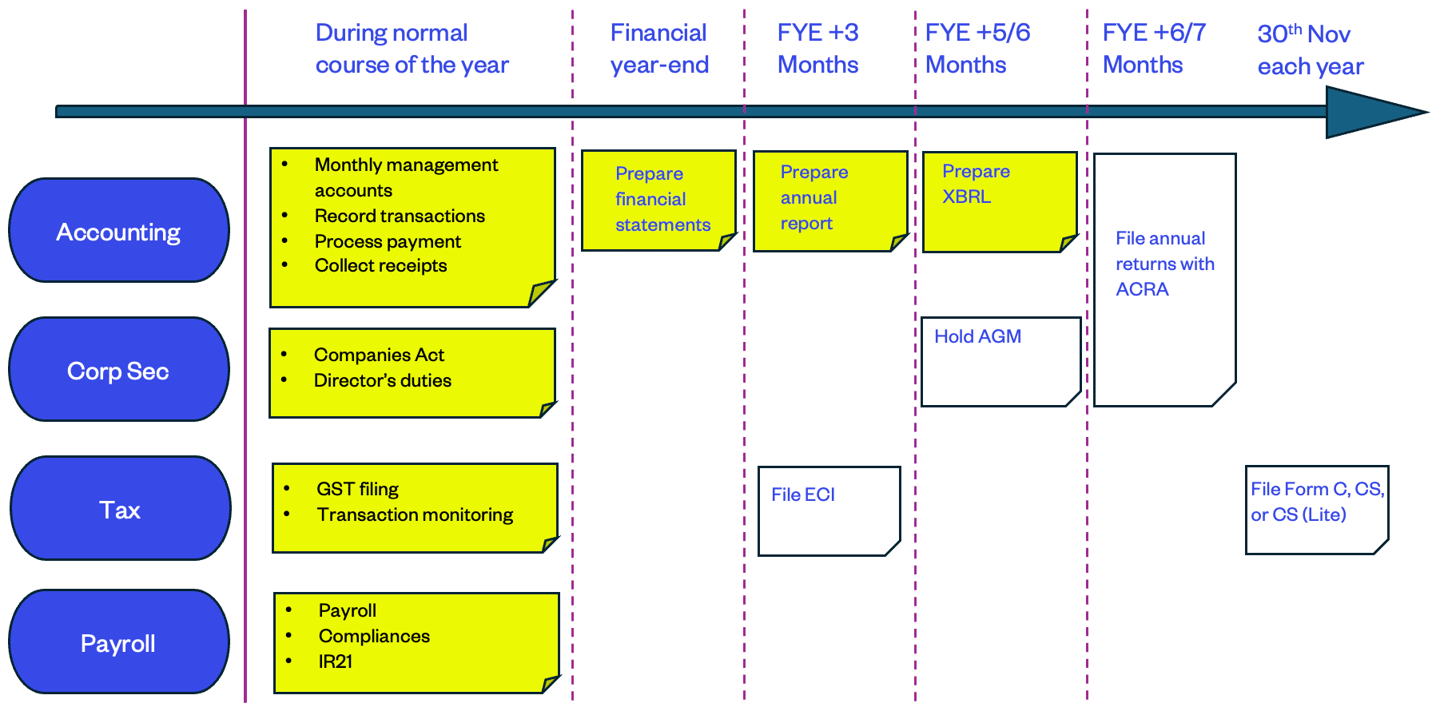

Corporate Secretarial

Guide and prepare your Annual Returns, AGMs, and any other Resolutions for day to day business transactions

Annual Returns: Plan & organise statutory meetings such as AGMs & Shareholder meetings

Director Resolutions: Guide and prepare essential documentation that supports your daily business operations and transactions

Transaction Monitoring

Stay on top of Director Duties, AML/CTF, ESG regulations that you need to comply with

Director Duties: Before entering into transactions, we help you provide fresh perspectives that mitigate the risk of breaching fiduciary duties

Loans and financing: Advise you how to avoid accidentally entering into financial assistance arrangements that may have criminal liabilities

Funding sources: Supporting your funding arrangements to comply with Anti-Money Laundering (AML) & Counter Terrorism Financing (CTF) guidelines, so that funding can reach your businesses without holdups.

Other Compliances: We can also help you with other compliances needs such as Payroll requirements from MOM (Ministry of Manpower), CPF (Central Provident Fund Board), BizSafe/WSQ, or other licensing needs.

Tax compliances

Maximise your returns through tax planning and avoid hefty penalties through tax compliances

Tax Planning: Plan your business decisions and financials way in advance to minimize tax leakages and maximise deductions and grants to improve your tax position

Estimated Chargeable Income (ECI): Prepare, review and approve your tax computation in advance to take advantage of the maximum instalment plans, and avoid over-paying taxes.

Tax Filing (Form C / C-S / C-S Lite): Support your tax filing deadlines and prepare the necessary tax supporting documentation.

GST Filing and Advisory: Maintain documentation and prepare computations for timely filing to avoid penalties.

Accounting & Finance

Plan & prepare your Company Financials for Statutory Financial Statements with full set of disclosures, and XBRL reporting

Book-keeping: Set up & maintain Chart of Accounts, Book-Keeping (monthly, quarterly or yearly) to record transactions meaningfully

Balance sheet reconciliations: Best practice schedules that verifies and confirms account balances to improve book confidence.

Annual report disclosures: Comprehensive reporting that is continually refreshed with the latest financial reporting standards, interpretations and disclosures that are relevant and important to your business

XBRL reporting and Audit support: Convert financial statements and file annual returns in XBRL format, support your statutory audit requests.

Compliance Calendar

Farm out your entire essential compliances to us or start modularly from $50/month

Tax

Tax Optimisation & Compliance

Corporate Secretarial

Meetings, Resolutions, Director Duties

Accounting

Statutory Reporting, Management Accounts

Frequently Asked Questions

What services do you offer?

We provide accounting, tax, and company secretarial services tailored for small businesses.

For example, preparation of annual report, XBRL filing, monthly management accounts, planning and executing your AGMs, etc.

How much can I save?

Our fixed pricing ensures cost certainty, allowing you to budget without unexpected fees or charges.

We do not want to be the cheapest in the market. Instead, we want to offer you superior value by providing solutions for the problems you are facing.

How does your fractional CFO help me?

You have another idea on how to improve your profits, but how do you know what risks you are facing or how does it affect your financials? Sometimes, you just need a business partner you can trust, and has the expertise to advise you on how to proceed or mitigate the risks.

You're right - It cannot be completely free. For most common transactions and issues, there will be no charges at all. However, if a more detailed engagement is required, for example, a full fledged Financial model preparation or Investment Due Diligence, this would be outside of the scope of the complimentary service.

All you need to do is to send an email, and you will find that at most times, the advice you need is now offered to you free of charge at no cost.

Fractional CFO services are usually very expensive. Are you sure it's free?

We combine high-quality work with lower costs.

We handle all compliance aspects diligently, treating your business as our own. Every situation is different and we will take every opportunity to learn and grow.

Start saving with us today

Expert accounting and tax solutions for businesses.

Contact

For further queries, drop us an email

askbsfs@gmail.com

+65 9779 3177

© 2025. All rights reserved.